Portfolio Compression Definition . portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. This can be useful for companies that need to comply with. this chapter should help the reader decide if a portfolio can be compressed or not. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions.

from www.lch.com

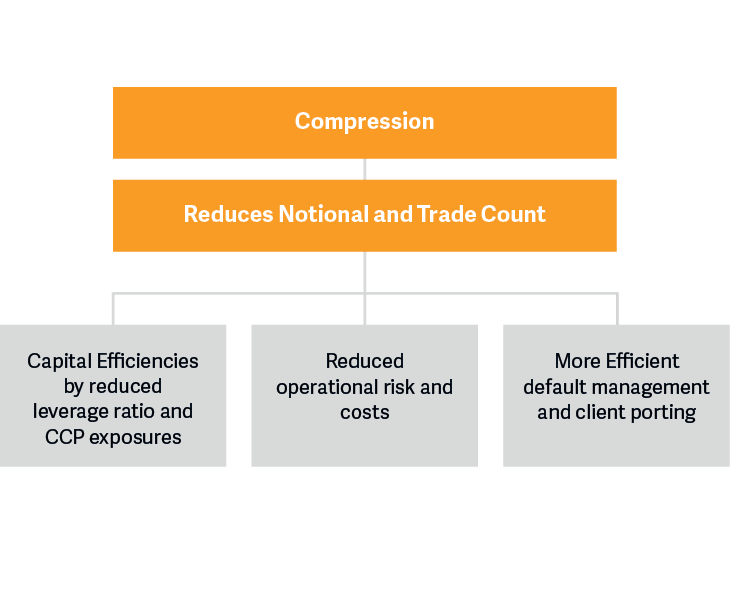

Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. This can be useful for companies that need to comply with. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. this chapter should help the reader decide if a portfolio can be compressed or not.

SwapClear Compression LCH Group

Portfolio Compression Definition this chapter should help the reader decide if a portfolio can be compressed or not. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. This can be useful for companies that need to comply with. this chapter should help the reader decide if a portfolio can be compressed or not.

From eduinput.com

Compression ForceDefinition, Effect, Uses, And Examples Portfolio Compression Definition mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression is a multilateral netting technique. Portfolio Compression Definition.

From osttra.com

Portfolio Compression OSTTRA Portfolio Compression Definition this chapter should help the reader decide if a portfolio can be compressed or not. This can be useful for companies that need to comply with. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the. Portfolio Compression Definition.

From www.techsparks.co.in

A Complete Guide To An Image Compression For M.Tech thesis Portfolio Compression Definition portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. this chapter should help the reader decide if a portfolio can be compressed or not. the economic. Portfolio Compression Definition.

From www.researchgate.net

(PDF) Physics of compression Definition and evaluation methods Portfolio Compression Definition Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression is a multilateral netting technique which enables market. Portfolio Compression Definition.

From eduinput.com

Compression ForceDefinition, Effect, Uses, And Examples Portfolio Compression Definition portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression is a multilateral netting technique which enables market. Portfolio Compression Definition.

From www.youtube.com

TOUT savoir sur le TAUX de COMPRESSION définition, mesure, TEST et Portfolio Compression Definition portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression. Portfolio Compression Definition.

From pediaa.com

Difference Between Lossy and Lossless Compression Portfolio Compression Definition this chapter should help the reader decide if a portfolio can be compressed or not. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. This can be. Portfolio Compression Definition.

From www.mindomo.com

Structural Strength and Stability Mind Map Portfolio Compression Definition portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. This can be useful for companies that need to comply with. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. portfolio compression. Portfolio Compression Definition.

From www.youtube.com

Pronunciation of Compression Definition of Compression YouTube Portfolio Compression Definition portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. mifir defines portfolio compression as “means a risk reduction service in which two. Portfolio Compression Definition.

From www.youtube.com

Compression — what is COMPRESSION definition YouTube Portfolio Compression Definition the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. this chapter. Portfolio Compression Definition.

From eduinput.com

Compression ForceDefinition, Effect, Uses, And Examples Portfolio Compression Definition this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression is a multilateral netting technique which. Portfolio Compression Definition.

From bitmovin.com

Lossy Compression Algorithms Ultimate Guide Bitmovin Portfolio Compression Definition Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. this chapter should help the reader decide if a portfolio can be compressed or not. This can be useful for companies that need to comply with. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression. Portfolio Compression Definition.

From eduinput.com

Compression ForceDefinition, Effect, Uses, And Examples Portfolio Compression Definition mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. This can be useful for companies that need to comply with. this chapter should help the reader decide if a portfolio can be compressed or not. portfolio compression is a multilateral netting technique which enables market. Portfolio Compression Definition.

From www.slideserve.com

PPT Chapter 9 PowerPoint Presentation, free download ID478332 Portfolio Compression Definition portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. This can be useful for companies that need to comply with. portfolio compression is a mechanisms that nets trades between two. Portfolio Compression Definition.

From ar.inspiredpencil.com

Compression Force Portfolio Compression Definition this chapter should help the reader decide if a portfolio can be compressed or not. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. Compression is a process of replacing multiple offsetting derivatives contracts with fewer. Portfolio Compression Definition.

From www.youtube.com

Determine a Horizontal Stretch or Horizontal Compression YouTube Portfolio Compression Definition portfolio compression is a multilateral netting technique which enables market participants to coordinate the replacement. the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. portfolio compression is a mechanisms. Portfolio Compression Definition.

From lasopaallabout560.weebly.com

What are the two types of image compression methods lasopaallabout Portfolio Compression Definition the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. This can be useful for companies that need to comply with. mifir defines portfolio compression as “means a risk reduction service in which two or more counterparties wholly or partially terminate some. portfolio compression is a mechanisms that nets trades between two. Portfolio Compression Definition.

From imagify.io

What’s Image Compression and How it Works Portfolio Compression Definition the economic meaning of portfolio compression lies in that it reduces notional outstanding by eliminating. portfolio compression is a mechanisms that nets trades between two or more counterparties such that the net positions. Compression is a process of replacing multiple offsetting derivatives contracts with fewer deals of. This can be useful for companies that need to comply with.. Portfolio Compression Definition.